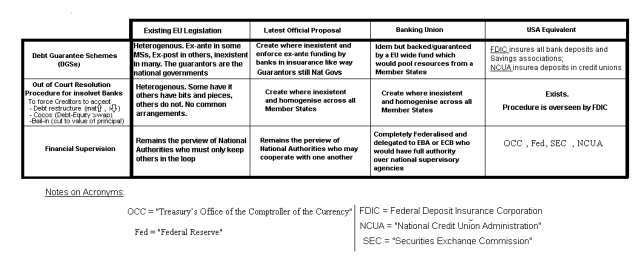

The point of this post is to summarise existing information about banking unions. This is a very vague term that incorporates several concepts. Therefore clarifying this seems quite timely, in light of ongoing discussions. This is briefly described in the table below, which is elaborated upon in the next few lines. This post is hugely indebted to the Bruegel article “What kind of European banking union?” by Jean Pisani-Ferry, André Sapir, Nicolas Véron, Guntram B. Wolff on 25th June 2012 and on “Banking crisis management in the European Union: Multiple regulators andresolution authorities” by Garcia and Nieto, who had the foresight of researching many of these issues in 2005. Other sources are discussed throughout.

Left out, but clearly implied in the table above is the existent of legislation that should cover all jurisdictions involved (i.e.: EU(ro) member states)

The Status Quo

Relevant and apologetic discussions on the poor state of EU banking institutions can be found at the relevant page on the European Commission’s Single Market website. The discussions that matter are those pertaining to:

- Legislation in force

- Deposit Guarantee Schemes (Proposals)

- Crisis management (for proposals and discussions of legislation pertaining to the recovery and resolution of insolvent banks)

- Winding-up of credit institutions ( for a description of the heterogeneity of present national arrangements)

As the European Commission admits in its Impact Assessments,

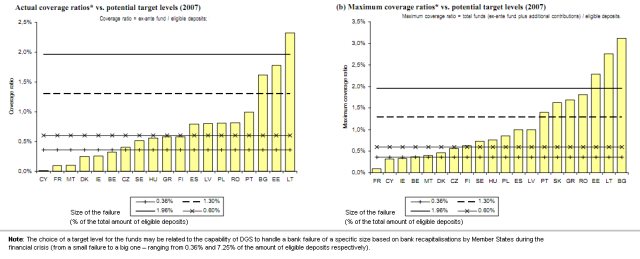

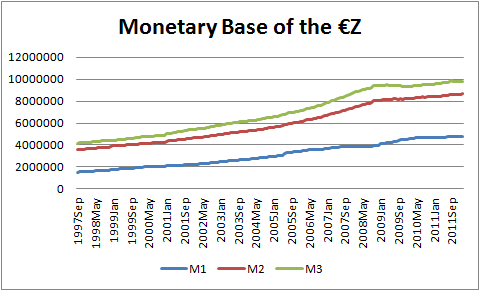

That’s putting it mildly. As the figures below show(Annex 16), the (actual or maximum) coverage ratio in the vast majority of EU countries was not sufficient to cope with even relatively small bank failures. In some cases ex-ante arrangements did not exist, while in other they were so small they barely existed…

As bank insolvency resolution,

Regarding centralisation of powers,

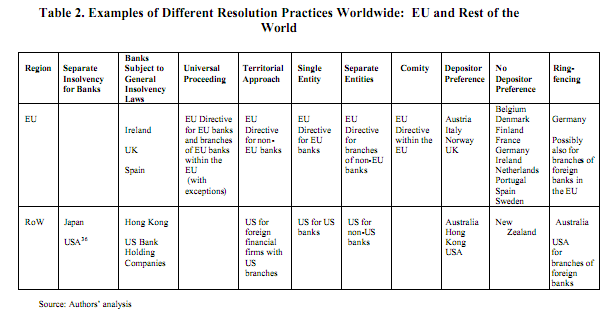

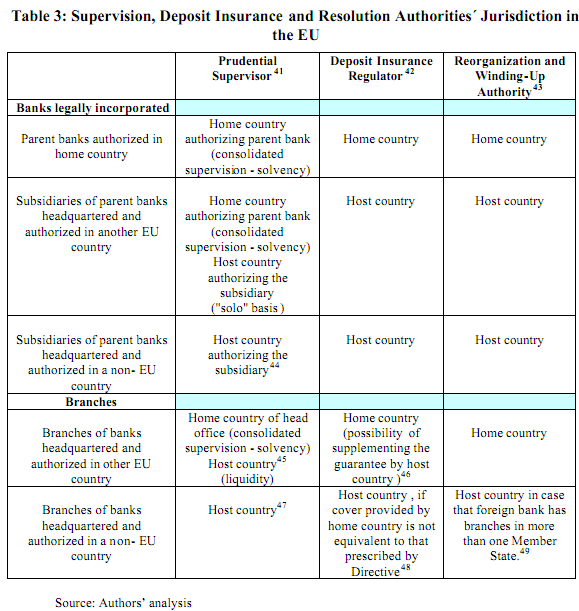

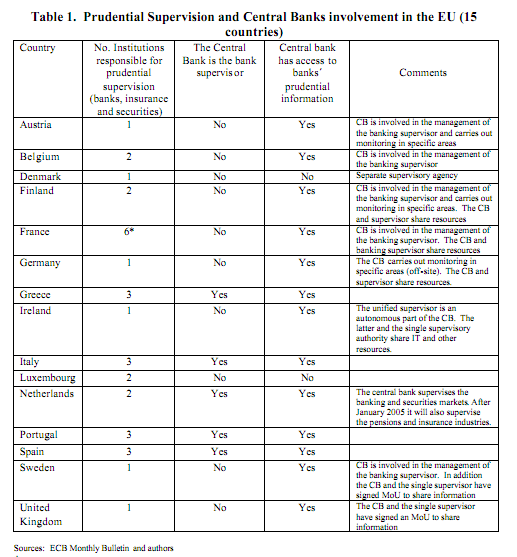

Garcia and Nieto (2005) illustrate this sadly unimproved state of affairs with disparate and uncoordinated supervision…

… heterogenous resolution practices…

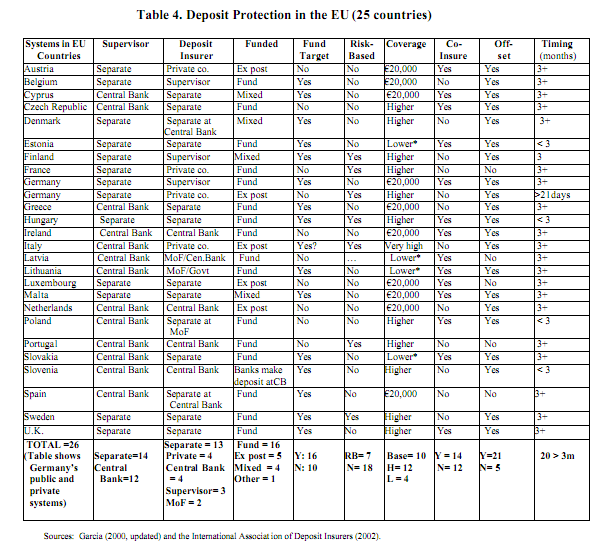

… and dispersed Deposit Insurance Schemes…

… all of which adds up to a very nationalist system..

… that has miserably failed to normalise the financial sector….

The New Proposals for a Banking Union

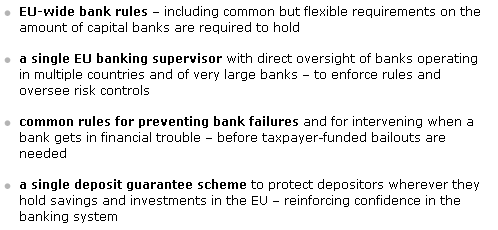

As described above, we are in a messy period of transition from a chaotic and disharmonious mess towards cooperation (initially) or centralisation (now). Most recently the European Commission published a press statement on its vision for the future of Banking integration on June 26:

Indeed, the momentum seems to be in favour of the more centralised approach. However, German official and banking objections remain… Notwithstanding them, both the IMF and the BIS support this move, as do Canada and the USA. Austrian member of the ECB’s governing council, Ewald Nowotny, has said that it could be implemented by the end of the year, while Praet has provided the sight of an ECB carrot, in the shape of a MRO rate cut, to reward well behaved countries.

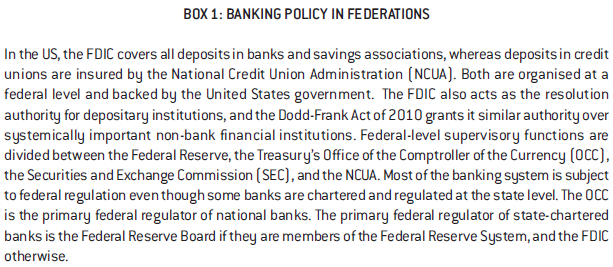

However, we need not reinvent the wheel. It is not as if no one else has a system such as this. As Bruegel describes in that article, the USA, and the FDIC (Wiki) in particular, provides a very interesting template for this reform in Europe:

If successful, such a reform would be tantamount to a leap in European integration and could potentially contribute to the resolution of the crisis.

For those interested, there are more in-depth discussions of these issues, provided by the World Bank, the UK Parliament, Gros, Shoenmaker and Beck (VoxEU) and Micossi (VoxEU).