Having looked at the tools available to the ECB, at its balance sheet, and at the transmission of monetary policy into the interbank lending market.after considering financial market failures due to Fractional Reserve Banking, overlending and VaR, I would like to turn my attention to the less orthodox interventions of the ECB. To this end I will spend the next few lines discussing the Covered Bond Purchase Programme, before looking at the Securities Market Programme.

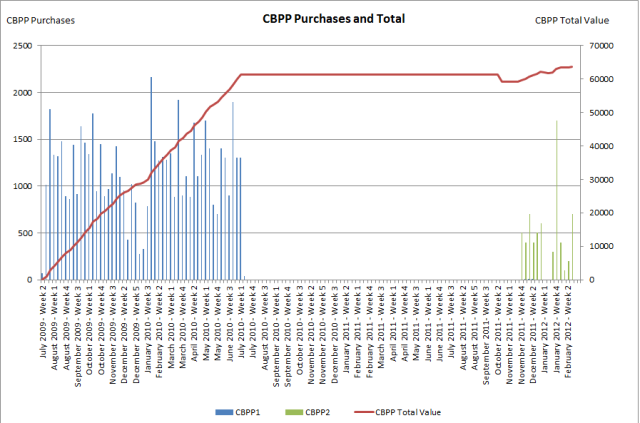

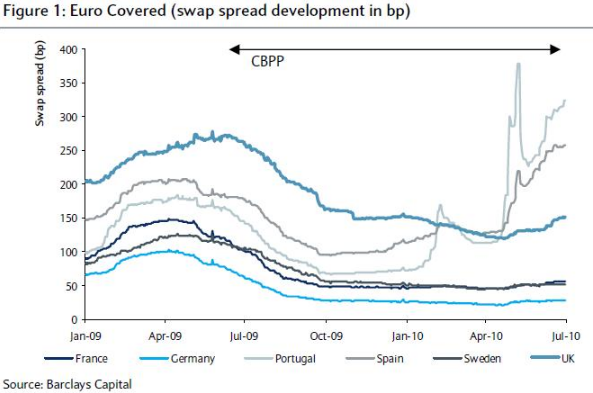

Programs of the ECB correspond to the strategies it pursues on a temporary basis to deal with specific monetary problems, not always limited to but, often concerned with liquidity in the interbanking market and the facilitation of monetary policy transmission. The Covered Bond Purchase Programme is one such case. Below I shall look at what these assets are, the timeline of the intervention, its mechanics, its causes and its consequences. Figure 1, below, shows the ECB’s intervention through the CBPP (CBPP1 and CBPP2) as described in the Weekly Balance Sheet reports:

What are Covered bonds?

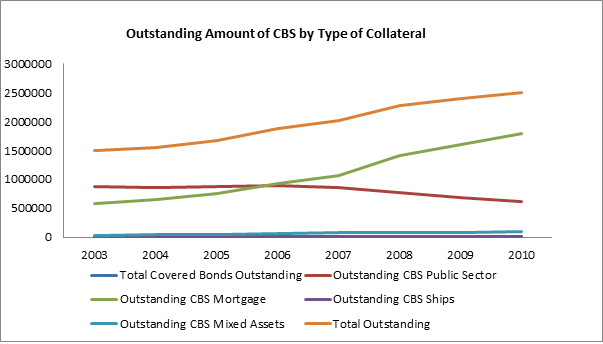

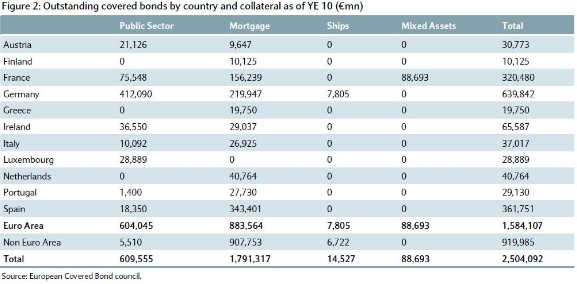

Covered bonds are debt securities issued by MFIs that are characterised by the fact that they are collateralised with “safe” assets, such as government bond, mortgages, etc. A formal legal definition can be found in the European Commission regulation, from July 20, 2011, according to “Part Three (Capital requirements), Title II (Capital requirements for credit risk), Chapter 2 (Standardised approach), Section 2 (Risk weights) under article 124” (slide 128). The European Covered Bond Council provides extensive information about this type of assets in its Fact Book. The figure summarises the evolution of covered bonds in the last 8 years, according to the collateral used.

Period of Operation

The Covered Bond Purchase Programme (CBPP) was a programme announced on May 7, 2009, on the basis of article 18 of the ECB statute. It has been in operation during two periods. The ECB first intervened between July 2009 and June 2010 (CBPP1), during which time the ECB outright purchased €60 bn of covered bonds. On October 6 2011, the ECB announced it would reactivate the programme (CBPP2) and that it was intended to amount to €40 bns between November 2011 and October 2012. On November 3, 2011, the ECB announced further details about maturities, eligibility and counterparties.

Causes of introduction of CBPP1

Following the subprime crisis that began in 2007 and exploded in September 2008, with the bankruptcy of Lehman Brothers, the turbulence began spreading to European financial markets. According to Beine et al (2011):

“As the crisis progressed and became more intensive at the beginning of 2009, spreads in the euro area covered bond market continued to widen, and liquidity continued to worsen .The financial crisis exacerbated the lack of confidence between banks, leading to a halt in interbank market activity. In turn, this raised concerns about the liquidity risk of a large number of banks and, to a certain extent, their solvency, thereby threatening the whole banking system. This scenario sets the context for the introduction of the European Central Bank’s decision to provide support to the covered bond market in the euro area through outright purchases of covered bonds under the Covered Bond Purchase Programme (CBPP).Specifically, it was felt that the CBPP ‘could help to revive this market, in terms of liquidity, issuance and spreads’.It was also felt that the CBPP could help to encourage lending to the non-financial sector given that the market was a major source of funding for euro area banks.”

The covered bond market was also perceived as relatively safer market to intervene in due to the relatively smaller risk associated with the collateral used for covered bonds, relative to, for example, Asset Backed Securities (ABS).

During the press conference in which he announced the unanimous council decision to implement the CBPP, back in May 9, 2009, Trichet, then President of the Governing Council of the ECB, had the following to say about the choice:

“Covered bonds were considered by the Governing Council as a segment of the private securities markets that in general has been particularly affected, more so than others, in terms of the impact of the financial turbulences.(…) €60 billion is only an order of magnitude, appropriate for attaining our goal, to help to revive this particular segment of the market.(…) No [the idea is not to inject liquidity],the idea is to revive the market, which has been very heavily affected, and all that goes with this revival, including the spreads, the depth and the liquidity of the market. We are not at all embarking on quantitative easing.”

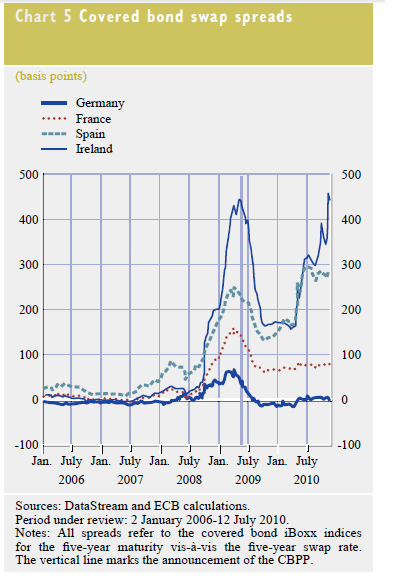

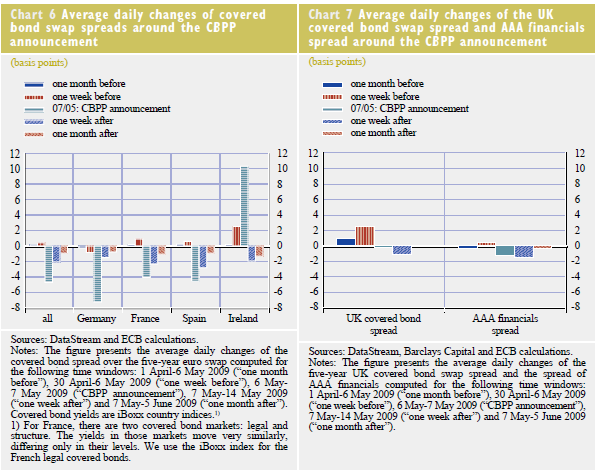

These “financial turbulences” are patent in the volatility of the of Covered bond swap spreads, particularly in Ireland and Spain but also in France. The chart below is provided by Beine et al (2011):

Mechanics – How does the CBPP work?

Trichet offered an explanation of how this intervention was not Quantitative Easing (QE,:

“If I might use our own vocabulary, it [ the CBPP] is part of our “enhanced credit support” operations. We have used this expression for quite a long period of time because we consider all the non-conventional measures we have taken in connection with the refinancing of banks as enhanced credit support. If you wish, you could call that credit easing, because it is a way of improving the functioning of the market that had been affected particularly markedly by the financial turbulences.”

In my opinion, it is less important what you call it than what it is. Through the CBPP, the ECB purchases covered bonds, both in primary and secondary markets, in order to provide liquidity to the financial sector. To limit the inflationary effects of those purchases, the ECB then sterilises these open market operations by auctioning fixed term deposits in order to stop the banking sector from increasing its loans to the overall public and increase inflation. To the best of my understanding this is QE.

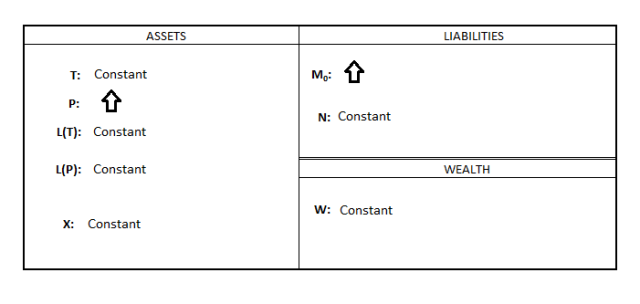

The following figure provides a simplified description of the ECB balance sheet mechanics of the CBPP. It is inspired by these blog posts from Professor Buiter (here, here and here).

“T” stands for treasury (sovereign debt) bonds, “P” stands for private securities (such as stocks, ABS, or indeed covered bonds), “L(T)” stands for loans to the private sector secured against “T”, “L(P)” stands for loans to the private sector secured against “P”, “X” stands for foreign reserves, “M0” corresponds to the monetary base (i.e.: money in circulation and bank deposits), “N” are the non-monetary liabilities of the ECB (such as CB bonds and bills) and “W” corresponds to net wealth, or equity, of the ECB. The figure shows that a purchase of securities by the ECB leads to an increase in the monetary base. One last important feature is that although the CBPP was decided by the ECB, it is implemented by national central banks.

Effects of CBPP1

I have been able to find two complementary accounts of the effects of the CBPP1. According to the first, by Beine et al (2011), the CBPP worked. It had three effects: It increased the amount of covered bonds issued, it led to a fall in spreads

1. The authors show that in the primary market, the CBPP led to a substitution in the issuance of uncovered bonds by covered ones. This is likely to be due to the fact that the intervention of the ECB made them safer, which goes a long way to prove that the intervention was successful. These results are arrived at by estimating equilibrium relationships in the Covered Bond Market through cointegration analysis. The authors provide tables for the estimation of a simple Error Correction Model (ECR) with 1 lag and 1 explanatory variable. Given the information available and the tests conducted, the results seem to be robust. Having estimated this relationship, the authors then use what is known as an event study to check whether the difference between covered and uncovered bonds reverts to equilibrium with the introduction of the CBPP. As the figure below is highlighted to show, there was indeed an upwards change in the negative path of the relationship back towards its long term equilibrium which coincides with the introduction of the CBPP. A similar change did not happen in the relationship between corporate and (total) bank bonds, implying that the CBPP’s effect was limited to the banking sector.

2. The authors then study effects of the CBPP on the secondary covered bond market. First, they consider the immediate effects. They show that the CBPP led to a sharp fall in spreads between the covered bond iBoxx indeces and the Swap rate during its first week of operation. Their analysis shows that this fall was a specific feature of Euro-Zone markets that did not take place in the Sterling markets.

3. Finally, the authors study the longer term effect that the CBPP had on the covered bond yields. To do this they study the changes in the spread between iBoxx country indeces and the debt yields of national agencies which the French and German governments individually guarantee. As the figure below shows, the effect of the CBPP on yield spreads was particularly visible in French financial markets, but also in German ones, bringing them down.

The second account complements this aggregate view by comparing it with specific banking developments in Spain, Italy and Portugal. In report by Barclays Capital, unfortunately unavailable to the public but described by FTAlphaville, its researchers highlighted the diversified impact that the CBPP was having on Euro-Zone member states.

It would seem that the brunt of the intervention took place outside of the periphery. This would make sense as Germany and France represented over 38% of the Covered Bond market.

Causes of end of CBPP1

The ECB June 2010 Final Monthly Report on the Eurosystem’s Covered Bond Purchasing Programme was not very celebratory, but it indicated that the CBPP had, indeed, served it stabilizing purpose:

“The downward pressure on secondary market turnover and prices faced by covered bonds in May and the first days of June 2010 receded during the rest of last month, and trading activity in the secondary market again turned out to be somewhat higher and more balanced in the last few weeks. The strong issuance activity in the primary market did not put significant extra pressure on secondary markets spreads, and new issuances were absorbed quite well. Overall, the spreads of euro area covered bonds over swap rates again increased slightly in June, while senior unsecured bond spreads tightened somewhat in comparison with the levels recorded at the end of May”

Thus, the first intervention in the covered bond market ended on June 30, 2010, as planned. Whether this was appropriate or not is arguable. Indeed, at the end of the coverage in Charts 5 and 8 and of figure 1, spreads increased again, ahead of the end of the CBPP1. In retrospect, the reintroduction of the CBPP2 seems to point in the direction of it having been premature to end the programme in the first place.

Causes of introduction of CBPP2:

Be it in the press conference following the October 6, 2011 meeting, in the October 2011 or in the November 2011 Monthly Bulletins, the ECB was consistently vague about its motivations for reactivating the CBPP. To the best of my understanding, the motivation was to restore the channel of monetary transmission. Indeed, according to Trichet:

“The large number of decisions taken today are monetary policy decisions in the domain of non-standard measures to help restore a better transmission of monetary policy in circumstances in which we have markets that are not functioning correctly or segments of market that have been disrupted.”

This would imply that the covered bond market was yet again disrupted. However, the form of this disruption was not clear. Neither Unicredit, nor Dansk Bank discussed any specific problems with the covered bonds market. Notwithstanding this, there are two possible reasons for the renewed intervention of the ECB.

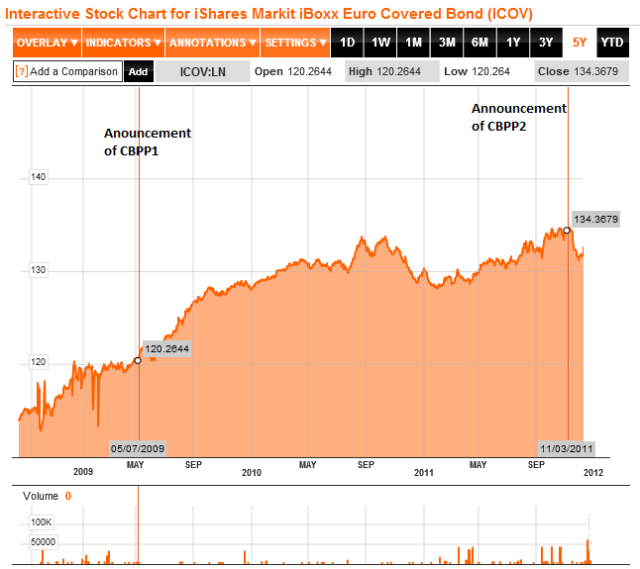

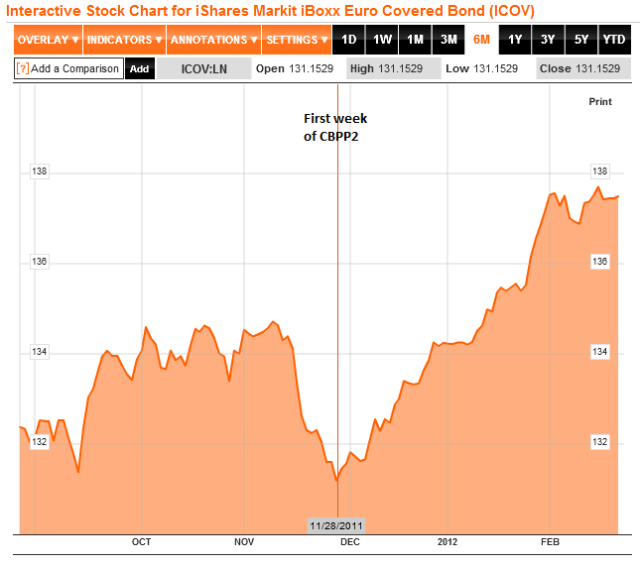

Specific conditions in the Covered bond market are difficult to gauge. In the absence of direct observations of the iBoxx Euro Covered Bond index and of outstanding covered bonds volumes, I use the iShares ETF Markit iBoxx Euro Covered Bond report, 2012, which tracks the underlying index quite well. The image below is publically provided by Bloomberg:

While confirming the relative, success of the CBPP1, unfortunately the figure above does not quite fit the hypothesis that on aggregate terms the Euro Covered bond market was going through any sort of trouble similar to the one preceding the introduction of the CBPP1. Clearly this figure provides very incomplete insights into the actual market conditions. It fails to shed any light on the specific national conditions of this market and it fails to take the swap rate into account. Nonetheless, on the face of it, there’s little evidence for the ECB to intervene. However, there’s another potential explanation.

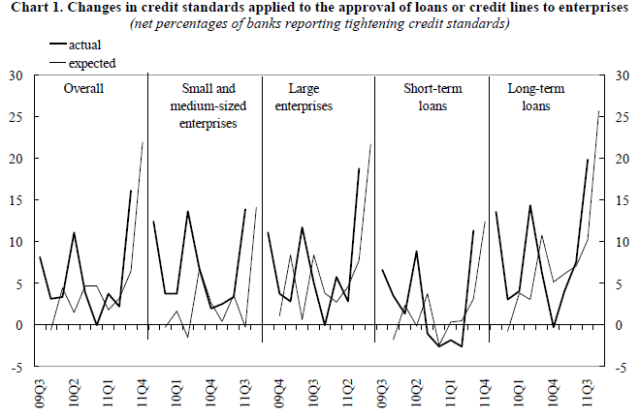

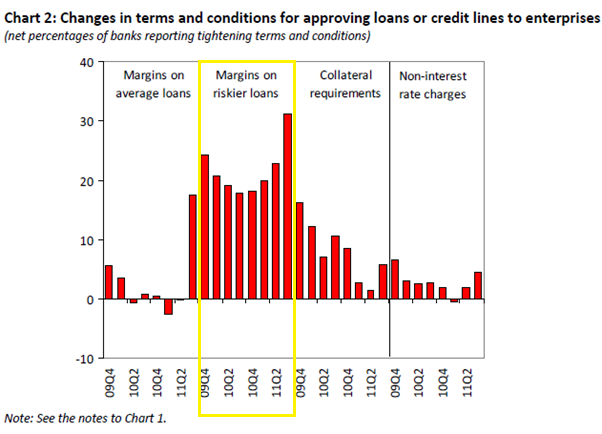

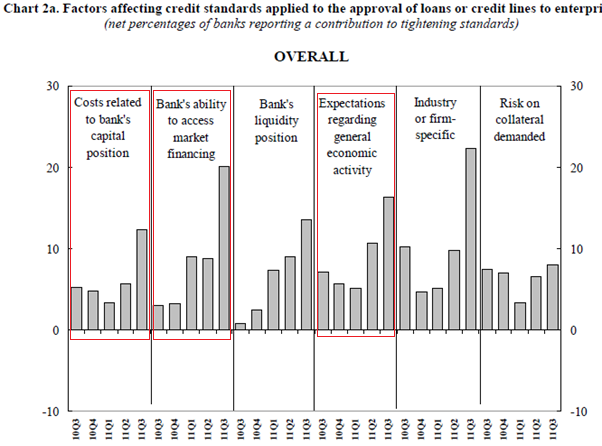

The other perspective, which was highlighted by Alliance Bernstein was that condition in the banking industry had deteriorated, which had been made evident by the latest Bank Lending Survey, published the day before the Governing Council meeting. That survey reports a deterioration of debtor financing conditions. This tightening is particularly visible in the restrictive lending conditions identified in the report. This tightening took place in both the market for loans to enterprises…

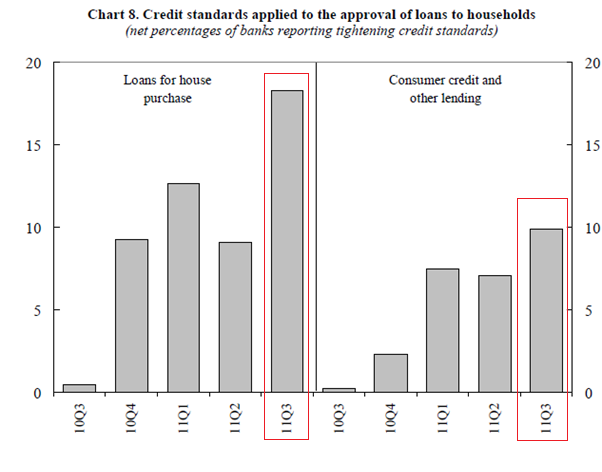

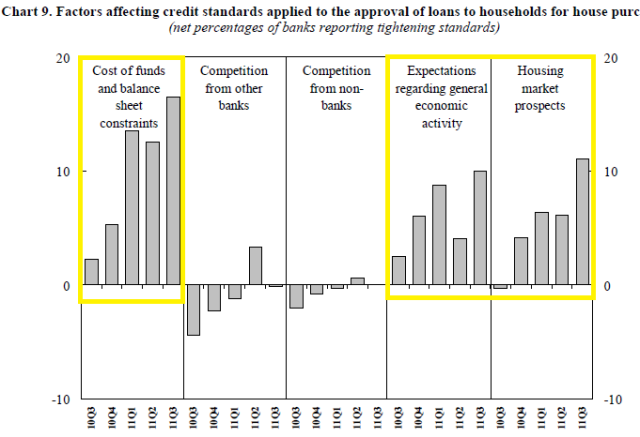

… as well as in the market for household debt

Effects of CBPP2

It is difficult to say whether the CBPP2 is having the desired effects on the market. Bank lending surveys conducted prior to the introduction of the CBPP1 showed that lending conditions were already improving, so it is difficult to pin the continued improvement in Q2 and Q3-2009 to the introduction of the programme. Similarly, according to the Q1-2012 Bank Lending Survey, lending conditions did not improve, following the introduction of CBPP2. These observations are consistent with the facts described in Beine et al (2011)’s Chart 4.

However, returning to the iBoxx Euro Covered bond index, the resumption of the CBPP2 by the ECB seems to have triggered a market rally. How representative this is of every Euro-zone country and how this is impacting the swap spread, is an unknown.

Effects of CBPP2

It is difficult to say whether the CBPP2 is having the desired effects on the market. Bank lending surveys conducted prior to the introduction of the CBPP1 showed that lending conditions were already improving, so it is difficult to pin the continued improvement in Q2 and Q3-2009 to the introduction of the programme. Similarly, according to the Q1-2012 Bank Lending Survey, lending conditions did not improve, following the introduction of CBPP2. These observations are consistent with the facts described in Beine et al (2011)’s Chart 4.

However, returning to the iBoxx Euro Covered bond index, the resumption of the CBPP2 by the ECB seems to have triggered a market rally. How representative this is of every Euro-zone country and how this is impacting the swap spread, is an unknown.

Conclusion

All in all, the evaluation of the CBPPs is mixed and yet uncertain. While the first instalment was successful on the aggregate, there seem to be some evidences that it failed to aid smaller but more cash-strapped banking systems.

Regarding the second intervention, while it failed to immediately stem the contraction in private credit markets, it may have been able to expand aggregate covered bond holdings and issuances much as it did in the first instance. More time should provide better information and processing of the unfolding events.

You seem to be one of the few who really bothers to take a closer look to such issues. I’d like to invite you to the Financial Research eXchange at FRXmarket.com & our FRX Community in LinkedIn. Right now we are determined to sort out the real situation in Europe. Here is our latest newsletter: http://eepurl.com/oKm9z

And thanks for the post, btw.

Thank you very much for your kind comments. You are very generous. 🙂

I will make sure to join your Linkedin group.

Best

You are welcome!

Thanks for your post. It’s very helpful for my research. Can I ask about the data source that you use for the first graph on CBPP purchase and total. Thanks again

I’m glad you enjoyed it!

I compiled the data from the weekly statements of the ECB. It takes a bit of time, but you can do it too. They are here:

http://www.ecb.int/press/pr/wfs/2013/html/index.en.html

Like I say on the post, you are interested in the period between June 2009-July2010 and between November 2011 and October 2012.

Good luck!

Thank you so much!

Pingback: Sovereign debt reaction to non-conventional monetary policies | ABC Economics - Abbiamo Bisogno di Crescita

Pingback: Euro Area Crisis: We are back in 2012 or worse | GEFIRA

Pingback: Euro Area Crisis: We are Back in 2012 and Even Worse | Newropeans Magazine

Pingback: Die Krise in der Eurozone: wir befinden uns wieder im Jahre 2012 und es ist noch schlimmer | Newropeans Magazine